scott pape: welcome tothe 2016 multi-agency webinar. i'm scott pape also knownas the barefoot investor and i'm passionate aboutincreasing financial literacy in the australiancommunity and about increasing the capabilityof australian small businesses so they canthrive and prosper. do you know that 97% ofall aussie businesses are actually classified assmall businesses so

there's no denying justhow significant the small business sector is withinthe aussie economy and i'm one of them. tonight we'll bediscussing how you can prepare yourself and yoursmall business so that it will be in the bestpossible position for the next financial year. i'm joined tonight bylynda mcalary-smith, who is the executivedirector of the proactive

compliance and educationbranch of the fair work ombudsman. lynda, tell us a littlebit about the fair work lynda mcalary-smith:thanks very much, scott. the fair work ombudsmanis australia's workplace relations regulator andit's a pleasure to be here tonight to talkabout our work. the majority of ourinteractions are helping employers and employeesunderstand the workplace

rules that apply to themaround hiring employees, setting pay, managingperformance and termination. this involves providingeducation and advice to employers and employeesthrough our fair work info line, small businesshelp line and our online resources. we also conduct auditsof businesses to check compliance and provideassistance with

particularly tricky areas. we investigate suspectedbreaches of workplace laws and, for the mostserious of matters, we take those who breakthe law to court. we also know that in everyworkplace there's the potential for disputes. our compliance andenforcement policy places emphasis on resolvingproblems at the workplace level and the preventionof those disputes through

the provision of adviceand support to make compliance andinteractions quicker and easier for both parties. almost 80% ofthe formal 25,000-odd matters weassisted in last financial year were addressedthrough our collaborative dispute resolutionprocesses. and although we have arange of compliance tools available to us, we'd verymuch prefer to leave them

in our bag and insteadwork with small businesses to get it right inthe first place. we want small businessesto come to us before a problem arises orescalates in their business. small businesses thatcome to us early are best placed toreceive our help. scott pape:thanks, lynda. now, to my right wehave - from asic,

we have joe zubic who isa senior manager of the small business complianceand deterrence team within asic. joe, can you tell us alittle bit about asic and its focus onsmall businesses? joe zubic:thank you, scott, and thanks for havingme here tonight. asic is an independentcommonwealth government agency.

it's australia'scorporate markets, financial servicesand credit regulator. now, while asic hasa very broad mandate, we are focused on threestrategic priorities or outcomes. now, the first one is toensure that investors and financial consumers areinformed and confident. now, education is verymuch the key here. we want to make surethat people understand

investing preferablybefore they actually make the investment. now, gatekeepers, suchas business advisors, play a very, veryimportant role here in helping asic informinvestors and consumers. but, you know, if thesebusiness advisors give the wrong advice, well, we'llcertainly hold them to account. our second strategicpriority is to ensure that

markets operate in a fair,orderly and transparent manner. now, we achieve thisthrough our role as market supervision andcompetition and also promote good corporategovernance and good corporate culture as well. our third strategicpriority is to ensure an efficient registrationand licensing with a particular focus onreducing red tape for

small businesses. now, one of asic'sresponsibilities, or key responsibilities,is to protect the financial well-being ofthe australian economy. now, small businessesplay a very, very important rolein the economy. for these reasons,there's about 4.1 million businesses, and i'mtalking about companies and business names thatare registered with asic,

and as you said, about97% of those are actually small businesses whichmakes them asic's biggest customer. they collectively employabout half the australian workforce and they accountfor about a third of the gdp. now, small businessesalso, as we know, bring new ideas andinnovation into communities so it'simportant for regulators

like asic to help smallbusiness as much as they possibly can. now, some of the wayswe can do this is by, as i said, reducing redtape imposed on small businesses and alsoproviding resources or relevant resources. scott pape: now,thanks for that, joe. down the end ofthe panel here we have dr michael schaper who'sthe deputy chair of the

australian competitionand consumer commission. michael, can you tell us alittle bit more about the accc and give us a quickrundown on some of the key areas. dr michael schaper:thanks, scott. as the name suggests,we're responsible for a number of areas that aregoing to be of interest to almost all businessoperators. first up, we're theregulator of competition

issues, how businessesdeal with each other, how they compete, evenissues such as mergers and whether big firms aremisusing some of their market power againstsmaller businesses. a second area that we'reinvolved with is consumer protection andinterestingly enough, scott, you'll be surprisedto discover that small businesses are oftenregarded as consumers as well under thelaw as well.

so it's not only abouthow you deal with your customers but also yourrights as a small business operator. our third area is thatwe're the national product safety regulator. we do a lot of recalls ondodgy products and the like. the fourth area isinfrastructure. we look after a rangeof areas, electricity,

some shipping areas, anumber of other ones. and the finalone is in scams, which i'll be mentioninga little bit later on. so whether you areselling to customers, whether you are justselling to other businesses, common issuesthat people are going to have come up in areassuch as pricing; what can i includein a price, what can't iinclude in a price,

what can i say in anadvertisement or what do i have to leave out, whatare my relationships with my suppliers and whathappens if a customer has a complaint or has acomplaint against me or is unhappy with somethingand wants a refund, for example. so all of those things areimportant and we have both the small businesshelp line, we have online educationalmaterial that people can

look at if they want to doit themselves in terms of a bit of education. and, finally, we alsocan provide referrals, for example, if smallbusinesses are in dispute with another one and needaccess to mediation as well so that'sjust part of it. scott pape:thanks, michael. very good. now, turningover to the ato,

we've got steve vespermanwho is the deputy commissioner ofsmall business. now, steve, we've hearda lot about the ato reinvention program. can you tell us a littlebit more about that? steve vesperman: yeah. thanks, scott. and we certainly don'tneed to do an introduction for the tax office but iwould like to share with

you some information aboutour reinvention of the ato program. what this reinventionprogram is about is about how do we now builda contemporary administration of the taxsystem which is meeting the community'sexpectations on the administrationof the system, taking advantage of thesort of technology that's available to us but alsorecognising that the

administration of thesystem is important for people to ensure thatthey're meeting their obligations and to giveconfidence and trust in the administrationof the system. so as part of thereinvention program, we went to many businessesright across australia and listened to what they saidto us about what that contemporaryadministration of the system would look like.

what small business saidto us was that they want a single and secure entrypoint into the tax office. they also want a systemwhere they tell us once where there are changesto their individual circumstances. they wanted an integrateddigital solution on a stable platform that fitsin with their current business applications. they also want a serviceany time, 24 hours,

seven days a week. and they also wantto ensure that every interaction with the taxoffice is personalised and tailored. now, they also said wewant the basics to be fixed and we have aprogram in place which is called fix it squadprogram which is looking at some of those basicirritants and resolving those irritants asmuch as possible.

we're starting to craftsome new products as well including a product thathelps with cash flow management that we hope tobe able distribute right throughout the smallbusiness community to help them understand how tomeet their, sort of, cash flow commitments andrequirements and help manage their business sothey're more successful. scott pape: now, steve,we are coming up to tax time so have yougot any tips for us?

steve vesperman: yes. the end of the yearis very important for all taxpayers that are in thesmall business community but i want to share withyou some of the new services that will beavailable at this time of the year which willhelp into the new year. so, for example, soletraders can now link their mygov account to theato to access the online services the taxoffice offers.

so that means that you canlodge and pay activity statements, view youraccount and set up payment arrangements and do muchmore with the online services. now, also, people who runtheir businesses through a company, partnership ortrust can now also use mygov to go online. they do need to linktheir abn to their mygov account and i do recommendthat if you are using tax

practitionersor bas agents, you check with your taxpractitioner or bas agent before doing this so thateveryone understands exactly what thearrangements are with the use of thoseparticular channels. something that you mighthave heard about is that this year we have replacedthe e-tax product. now, the e-tax productis used by people who self-prepare.

they prepare their own andlodge their own returns. and that e-tax product hasbeen replaced by the mytax product. now, the mytax productwill be available for small businesses, verysmall businesses, for example, or part-timebusinesses who want to lodge and preparetheir own returns. so that mytax product isnow available from the start of the nextfinancial year and it'll

be a service that peoplewill find very streamlined and very efficient. in addition to that, wehave after-hours call back services, we have web chatservices available to get as much assistance thatyou need to help with your end-of-year taxobligations. i'd like to also suggestthat where businesses are of a size where they couldget real advantages with the use ofcomputer software,

we work with softwaredevelopers to ensure that their products are meetingthe needs of small business in terms ofmeeting their ongoing tax obligations. scott pape:thanks, steve. now, lynda, i understandit's during this time of the year when there arepotential increases to the minimum wage. as employers, what dowe need to be aware of?

lynda mcalary-smith:that's right, scott. one of the most importantthings to be aware of is that there is a minimumwage in the first place and all workers in thiscountry are entitled to a minimum wage which iseither set by the modern award, their enterpriseagreement or if they're award and agreement free,the national minimum wage. employers must pay atleast the minimum wage for each hour worked.

it's not a ceiling. you can pay your employeeswhat you think they're worth but theymust be paid the minimum. what that wage will bewill depend on a range of factors includingtheir age, the type of work theydo, whether they may be working full-time,part-time or casual and also what day or time ofthe week they worked that week, so if, for example,are they entitled to get

penalty rates. the minimum wageis, as you've said, subject to annualincreases which are normally announced aroundthis time of year, so usually in may or june. and, in fact,just last week, the latest decision washanded down by the fair work commission andthe increase for this financial year is 2.4%,taking the national

minimum wage from $17.29an hour up to $17.70 per hour. now, this increase willtake effect from the first full pay period on orafter 1 july this year. and to help you easilycheck what that new pay rate will befor your staff, you can use the fairwork ombudsman's pay and conditions tool,also known as pact. by answering a series ofpretty simple questions,

pact actually does thehard work for you. it calculates thewages, allowances, overtime and even thepenalty rates for your employees. also annual leave,personal leave and any other entitlements to bepaid on termination can also be calculatedthrough pact. you can find pact atfairwork.gov.au and it's just locatedunder the pay tab.

scott pape: so,lynda, in my business, we pay above minimumrates of pay. do we still need toworry about this? lynda mcalary-smith:absolutely, scott. it's not uncommon foremployers to pay above the minimums and, aswe say, you know, you pay what you needto get and, of course, keep really good staff. but even if you are payingthe employees above the

minimum rate of pay, it'sstill really important to stay across the wagereview updates. this gives you the bestchance of ensuring that, in fact, you are stillpaying above the minimum and the average andthat you don't run the risk of underpayingyour staff as well. it's about beingconscious about it. scott pape: thanks. now, joe, it's myunderstanding that,

by law, small businessowners have to keep written financial records. can you give us a bit ofan outline as to what we actually need to keepand for how long? joe zubic:certainly, scott. i don't want to get boggeddown in the technicalities of the law so i'll tryand keep this pretty high level. so the corporation actrequires that companies

must keep writtenfinancial records that correctly record andexplain its transactions and financial positionand performance and would enable the true and fairfinancial statements to be prepared and audited. so for small businesses,financial records might include thingslike invoices, receipt borders forpayment of monies, bills of exchange,cheques,

working papers and otherdocuments needed to explain the methods bywhich financial statements are prepared. now, financial records maybe kept in hard copy or maybe kept electronicallyor a combination of both. and there are numerousaccounting software packages out thereavailable for this purpose. now, although thecorporations act does not

require small proprietarycompanies to prepare financial statementsunless requested by asic or shareholders, theyare considered to be a valuable tool for managingyour company and checking its progress and financialposition and may be helpful if you'recontemplating upgrading finance. now, i'm often asked howlong do we need to keep these invoicesor records for.

well, the corporations actsays you need to keep them for seven years afterthe date of the actual transaction. scott pape: okay. thanks, joe. now, steve, for peoplewatching who are just starting out in business,how is the ato helping them, you know, get itright from the very start? scott, you wouldappreciate that and we

know from experience, thatthe best way to ensure a successful business is toget it right from upfront. so we are really keen toensure we provide as much support and advice aspossible for those who are starting a new business. so, as of now, newbusinesses receive what we call a new businessessentials pack via an email within 30 days of anew businesses registering with us and that meansthat throughout the year,

they receive monthlyupdates from us but they also get some informationabout how to link to online learning modules tohelp them get things right from the start. there's very clear andeasy to navigate, sort of, tools available to providethat information and support. there's some tips, toolsand other resources for business planning andsuccess and the more

people understand how toget it right from the beginning makes it mucheasier a bit further down the track. we also have available asmall business news room, scott. i'm not sure if you'reaware of it but it's a digital news andinformation service where subscribers can choosetopics of interest, they can choose whichcontent is received,

quickly scan ato updatesfor relevance to them, download important datesinto their own calendars and share articlesvia social media. so it's another importantservice that we provide for all business butparticularly new businesses. now, have you ever beenoffered a written contract on a take-it-or-leave-itbasis by a bigger business?

have there been terms inthat contract that you felt were unfair? well, dr schaper hasthe latest on some new protections forsmall businesses. dr michaelschaper: and, scott, i think one of those mostmemorable lines in life is just sign on the dottedline and it'll all be okay. i think all of us ascustomers, as consumers,

at some stage or anotherhave signed up to something, a phonecontract, a hire car, whatever it might be, andthought there's a lot of fine print in here and i'mreally not quite sure what it's all about. and for several years nowas a general member of the public, as a consumer,we've had protections against those in the sensethat anything that is regarded as an unfaircontract term can be

struck out by a court andan unfair contract term is something that, well, itisn't really necessary for the business to haveimposed it in the first place. secondly, it will actuallycause some sort of detriment to you if it'srelied upon and a number of other clauses as well. and these are reallysignificant ones that cause a major imbalancein the rights and

responsibilities betweenyou and the business. now, parliament hasrecently amended the law so that it also extendsthose rights and those protections now to smallbusinesses or rather it will from the middleof november this year. so there's a reallyimportant thing to think about here rightnow, scott. if you are on the cuspof signing a contract, a standard form contractof any sort - and a

standard form contract canbe anything like a lease, it can be an ongoingarrangement for supplies or equipment, it couldbe for the purchase of services - then you needto ask yourself should i perhaps see if i caneither wait until after november when thesenew rights come in or, alternatively, maybe takea short-term contract to cover the period upbecause it will only apply to business contracts- business-to-business

contracts from 12november onwards. an important thing to alsobear in mind here, scott, is that it is fairly aimedat small businesses so that means a business withless than 20 employees and where the contract itselfis worth less than $300,000 or, as manypeople have multiple-year contracts, lessthan a $1 million. now, the sorts ofindustries that we've got a special interest onright at the outset are

areas such as franchising,retail leasing, independent contracting,advertising and i mentioned telcos before. and the sorts of nastiesthat sometimes you need to keep an eye out forin your contracts are conditions that,for example, might allow theother business, usually a biggerbusiness, for example, to charge you if you wantto get out of the contract

but not them if they wantto leave the contract. another one that's verycommon is a term that allows the big businessto change any of the conditions as they see fitbut doesn't give you the right as well. and a third one is onewhere they shift the legal liabilities, indemnities,the responsibilities on to you rather than on tothemselves so even though they may beresponsible at times,

you'll actually endup wearing the can. so if you're facingthose sort of things, you really need to thinknot only do i need to talk to a lawyerabout this but, given these protectionsare coming in november, can i wait until then? scott pape: now if you've ever used acredit or debit card and been hit with a surcharge,the government has

introduced new lawsbanning excessive surcharges and the accchas an important role to play. michael, can you pleasefill us in on how this ban is actually going to work? dr michael schaper:well, scott, i think you're right atthe very outset there. i think we've all used acredit card and thought what have i been chargedthis fee for and more

importantly, this justdoesn't seem to be the real cost of usingthe credit card. so whether it'sa credit card, whether it's a debit card,whether it's eftpos, all of them have sometimesthese same sort of - again, it's aform of a nasty. so from september, largebusinesses this year will be required to actuallymake sure that if they're charging - puttinga surcharge on you,

then it reflects the realcost of using that credit card. other businesses, smallerbusinesses in australia, will also have to do thatbut they'll be given a year's grace. so they won't have tocomply with it until next september. so from start ofseptember this year, big businesses willhave to comply with it,

from september 2017, ifyou're a small business operator, you'll haveto comply with it. so this means,for example, that if you are chargingpeople a fee for using, for example, eftpos, anamex card, a visa card, a mastercard, you need tomake sure that it only reflects the realcost of doing that. your bank, if you'rea small business, or your credit cardmerchant provider will

send you that informationfrom september next year and you'll be able to usethat as the figure to work out this is thesame amount. so if it costs me 1% touse a particular credit card, then that's as muchas i'll be able to charge you. if i charge anythingmore than that, then clearly you're goingto run into problems. but also you need to keepan eye out am i going to

be hit for higher chargesand then you can - you rightfully go back andask the question there. there's a couple ofexemptions but that's the major thing to beaware of, scott. scott pape: very, verygood news, michael. now, lynda, what would yourecommend small business employers do to preparethemselves and their employees for thecoming financial year? >>lyndamcalary-smith: well,

the start of anyfinancial year, scott, is a great chance to takestock-take of what you're doing in your business andmanaging your employees is no different. so the start of a newfinancial year is a great time to - we wouldencourage businesses to explore having aperformance review cycle within their business. and it doesn't matter howbig or how little they

are, you all want yourstaff to be doing the best job that they can for youso that they can help you grow your business. now, we have a managingperformance course which you can access though ouronline learning centre on fairwork.gov.au whichhelps take you through the practical skills andknow-how about promoting good performance in yourworkplace and, of course, because it happens,addressing

under-performancewhen it does come up. the module is interactiveand offers a tool kit of useful resources to helpyou easily implement a performance system becauseit shouldn't be hard. some of these thingsinclude template performance agreements,template letters of warning if, unfortunately,you do need to use those, and a performance meetingplan check list that you can both use.

it also offers theopportunity to learn some best practice methods totake some of the guess work out of having theseconversations around common performance topicssuch as not only managing under-performance but alsorecognising good employee performance because youwant to make sure that your good employees aredeveloping as well. it lets you practisehaving some of these sometimes uncomfortableconversations so that

you're a bit moreconfident when you're going in whenthe time arrives. we also have a number ofother courses to help employers prepare learningand development plans for the coming year fortheir employees and this includes our hiringemployees course which takes you through theprocess right from day dot; how to design a jobthrough how to interview and suss out who's just agood interviewee and who

would be a good employeeand carrying out a successful induction. our difficultconversations in the workplace courses are alsowhere you can get practice having a difficultconversation with an employee through a seriesof choose your own adventure videos where youactually get to practise. we also have an employeeversion as well because it's really importantthat you can build up the

capability in your staffand the confidence so that they're not scaredto have these kind of conversations with theirmanagers if there are issues. encouraging employees tohave confidence to raise issues with you in thefirst instance rather than coming to us, for example,as the third party, can save your businesstime and effort. we also have a range oftemplates designed to make

it easy for you toprepare your employment documentation becausenobody loves spending time on the admin side ofrunning their business. they want to get stuckinto actually running their business. these include recordkeeping templates such as our time sheet and paysliptemplates but also letter templates includinghiring someone, performance managementtemplates as well.

whatever performancesystem you use, it doesn't needto be complicated, it just needs to begenuine and consistent. scott pape: cani just say also, as a small businessowner, your templates, i have used them andthey're absolutely - absolute gold so go to thewebsite and check them out. i did and i was amazedat what i found.

michael, for many yearswe've said scams, if it's too good to betrue run the other way. small business owners, howcan we make sure that we don't get conned? dr michaelschaper: look, it's an interestingone, scott. we often hear about scams. i think almost everyonehas got that email that's mysteriously appeared froma bank saying "lost all

your details, exceptyour email address, just kindly tellus your name, your date of birth and allyour personal information and the world will be abetter place." and yet what most people don'trealise is that small businesses are actuallymore likely to fall victim than members of thegeneral public. and so part of that isbecause small business operators aretime pressed,

they often don't havegood security systems and there's a couple of nastyscams doing the rounds at the moment. in fact, as you can seethere from the information up in front of you, lastyear our scam watch centre saw more than 3500contacts from small businesses about scams anda large amount of money there, almost$3 million lost. now, three particular onesthat are doing the rounds

at the moment are reallyworth keeping an eye out for. first of all, almost allbusinesses come across false billing scams. these can come to you asan email but they can also still come in goodold-fashioned snail mail and sometimes evenby a phone call, placing a product, here'sa domain name registration where you think i'm surei renewed that recently.

here's an invoice that youthink someone must have ordered it but i don'trecall us doing it but, what the heck, pay it andi don't want to have the reputation of not beinggood with my bills so i'll pay it. and so sometimes they'requite small amounts, sometimes they're largebut just think before you pay a bill, especiallyif it's irregular or it doesn't seem like one thatour business actually

does. now, if you are aslightly bigger business, one of the things that'sdoing the rounds at the moment is thefake ceo scam. this is where scammers areable to build up a profile of the key people in abusiness, who the ceo is, where they are, even theirconversational style on an email, who the chieffinancial officer is or the major people that makepayments and then send

emails through to thefinance officer saying - purporting tobe the ceo and saying, "i need you tomake this payment. it's a bit unorthodox. take this email,for example, as my authority to do it. i need you pay it tothis bank account. yes, it's an unusualbank account. it needs to be done andit needs to be done right

away." and the reason itneeds to be done right away, scott, is that thatmoney is going to go to probably an offshore bankaccount and, very quickly, it's going to be moved onsomewhere else and it will not be recoverable. so if you're gettingemails and you think we don't usually operatethis way inside, there's probablya good reason. and the final one, whichis really hurting a lot of

business, especially smallservices business is ransomware. you open up an email,you unzip a file, for example - it oftencomes as a zip attachment. it seems to befrom a legitimate, well known source andwhat it actually does is capture your databaseand then basically the ransomer will cometo you and say, "here is a fee that you'regoing to have to pay if

you want to get your databack." and this can be devastating. i mean, many of us storeall our information electronically and ifyou were to lose that, it's almost the deathknell of your business in many cases. so there's a reallyclear lesson here. first of all, do not openthings that you are not familiar with, especiallyif they are zip files.

and, secondly, do makesure that you back up and you back up off-line. now, scott, there areprobably a couple of other tips that i'd suggest alsoyou need to think about. if you're runningyour own business, make sure that you limitwho's got authority to make payments so thatscammers don't have the capacity to prey ondifferent people being uninformed about whatshould or shouldn't be

paid, keep your filing andaccounting systems up to date, and i think thatprobably is news to the ears of people like joeand lynda and it certainly is of steve because itreally is what all of us are saying here. good records are goodbusiness practice as well as good regulatoryrequirements. and i think, finally,also really basic, don't forget to updateyour security software

from time to time as well. basic but stillvery important. scott pape: verygood points, michael. and i get - probably twoor three times a year, i get the domain name fromthe letter telling me to renew from some placethat i've never heard of, so they are certainlytargeting us. now, joe, inmy experience, some business owners findit difficult to juggle

running a business andthen also the keeping up to date withthe paperwork. just how important isit for businesses to understand the truefinancial position that they're in? joe zubic: yes, scott,i think it's very, very important forbusiness owners to know whether or not theirbusinesses are solvent and what that actually meansis can they pay their

debts as and when theyactually fall due. now, taking the time tounderstand financial documents will give youmore control and a clearer picture of your businessand how it's actually performing. the two basic documents,or financial documents, that give you thisinformation are the profit and loss statementand the balance sheet. so, as youmentioned, scott,

as a small business owner,learning about accounting topics and financialreports may not be the top of your listunless, of course, you might bean accountant. however, taking or havinga basic understanding of these financial reportscan make a real big difference to managingyour businesses. it'll help you to makebetter decisions and improve your ability tocommunicate productive

with your accountantand other advisors. in simple terms, a profitand loss statement, otherwise known as astatement of financial performance, providesa picture of how your business is tradingover a defined period, and that might be, youknow, over a week, over a monthor over a year. it recordssales, expenses, profits and losses and taxpayments for that period.

now, a balance sheet,otherwise known as a statement offinancial position, paints a picture of yourbusiness's financial strengths at the end ofan accounting period. now, these are the twodocuments people should familiarisethemselves with. so even if they did somebasic course in finance, these are the twodocuments that i would recommend that they havean understanding of.

scott pape: sure. and you can get that withyour accounting software you can get those reports,they're fairly easy to download. now, in my work, i'vecome across many small businesses that rely ontheir accountant or their business advisors to helpthem understand and comply with all the regulationthat we need to. so how can small businessadvisors meet their

expectations of the smallbusiness that is actually placed on them. lynda? lynda mcalary-smith:well, scott, we know that smallbusiness advisors, accountants, lawyers,employer organisations and the like play suchan important role in supporting and providingadvice to small businesses because they have a realunderstanding of that

business and industry. as trusted advisorsto small business, that brings bothopportunities and also responsibilities as well. so advisors have theopportunity to help small business make theright decisions. and, of course, this isall about building better businesses that are moreproductive and more profitable in the end.

however, small businessadvisors also have a responsibility to ensurethat they are protecting their clients' interestsby promoting or helping them to implementcompliant workplace practises. they also have theresponsibility to be observant and proactiveand to make inquiries if they think something'snot quite right. they need to be confidentand knowledgeable.

where advisorsobserve an issue, we expect them toacknowledge it and to work with theirclients to fix it. small business advisorsare encouraged also to access our suite of freetools and resources to ensure that they keeptheir workplace knowledge up to date, if that'swhat they're advising on, and only provide theirclients with information that they actually knowis correct not what their

fellow business operatormight have told them. if a small businessadvisor provides advice that they know contravenesa workplace law, it's really importantfor the small business advisors out there tonightto be aware that they themselves can becomepersonally liable as an accessory under section550 of the fair work act and may be subject topenalties themselves and that's personally and thatdoesn't mean if you have a

company, if you havean incorporation. so if you're giving thewrong advice knowingly, you can end up in a lotof hot water yourself. now, steve, what's the atodoing to cut red tape for small businesses? steve vesperman:yeah, scott, and before i share someexciting news with you, i would like to add towhat joe was saying about the financialposition of a company.

we find, fromour perspective, that understanding profitmargins and understanding cash flow management isabsolutely critical for a small business personbecause you maintain the viability of a business ifyou do understand those two key points. so i think it is reallyimportant that small business do focus on that. so, yes, i have gotsome exciting news.

one of the key messages weheard from small business when we were doing theconsulting was that there's significant costsof compliance inherent in meeting gst reportingrequirements. so we've listened to thatand we're now looking at ways of simplifying thegst reporting requirements on the business activitystatement and we're now mapping out how todeliver that outcome. so from 1 july this year,we are starting a pilot,

working with taxpractitioners and software developers, to simplifythe gst coding and reporting requirements onthe activity statement. this will include theactual - what coding requirements are requiredand that will be built into those accountingsoftware packages that are used by our smallbusiness people. and we'll also look athow that feeds into the preparation of thebusiness activity

statement. so this pilot begins from1 july but we are very keen to see how we rollthis out over the next 12-month period. now, joe, i askedsteve about red tape, let's talk about asic andwhat you guys are doing to help small businessescomply with all the regulations thatwe're hit with? joe zubic: sure.

business owners thatcan be overwhelming. often that information canbe in the language that the business owners justdon't quite understand. now, there's a lot ofinformation available to now, asic and the otherpanellists here tonight, they know this, theyunderstand that and have worked very, very hard toprovide information that's accessible andeasy to understand. now, in regard to yourobligations to asic,

a good place to start isthe asic website and, particularly, undera banner called for businesses. and there you'll findcertain information that's in a language that'sreally easy to understand and digest. we do have a bookletcalled your obligations as a small business operatorwhich is also available in hard copy.

it's an easy-to-read guideon your responsibilities as a company director,including your potential liabilities. we also have the asicsmall business hub. it's dedicated exclusivelyfor small business operators. the website provides anoverview of what you need to know when you'restarting up a business, compliance obligations aswell as what you need to

know when you'reclosing a business down. the small business hubcontains a number of one-minute guides thatprovide summarised and targeted information aswell as a number of useful links that sign postsyou to other relevant information at asic or theother regulators might have. we have a newsletter thatyou can subscribe to and every three orfour months,

we will send you somerelevant information. and we also have the asicguide for small business directors, whichwas, by the way, set up after one of thefix it squads that we were engaged with, with theato and a number of other regulators, and thereyou'll find information specifically in relationto your obligations if you're running abusiness as a company. we also have the asicbusiness checks.

i know steve and michaeltalked about scammers that are out there. now, this is an app thatwe designed that you can download on your smartphone where you can make some easy-to - you canactually make some inquiries,easy-to-understand inquiries, basictype of things, to see whether or not youmight be actually getting scammed.

and so, essentially, itfollows three protocols and that is really toask questions that are relevant to the peopleyou're actually dealing with, make inquiries andif you suspect anything, then come and report it toasic or the actual other regulators. scott pape: thanks, joe. and i will just say thati am a subscriber to the newsletter and i wouldencourage everybody to do

it because it gives youjust some really handy tips. now, lynda, from whatyou've told us tonight, there seems to be a lotthat we need to get across in the workplacerelations space. where should smallbusiness's employers start when seeking to increasetheir, i guess, workplace iq. what do they do?

how do we make surethat we're up to date? lynda mcalary-smith: ithink one of the important things, scott, is, as youdo with your business, is working on the businessnot just in the business and prioritising that asan important focus of your attention at certainpoints in the year. there's a lot of goodresources that we've heard about today that areavailable to help small and a small businessemployer who's made the

decision to increasetheir knowledge and understanding of workplacerelations has made the first right step interms of having a great workplace. one of the second stepswhich i would suggest would be to access ourworkplace basics quiz at fairwork.gov.au. as you've said, scott,there are a lot of different things forpeople to get across and

this quiz can take youthrough some of the basics, provides you withan opportunity first to test what is your actualknowledge and what's your current level of knowledgeabout everyday workplace issues that might come upin your business including pay and awards, leave,record keeping and payslips, typesof employment and termination, includingredundancy because at different times inyour business cycle,

that might be somethingyou're having to address. the quiz also gives youthe opportunity to test you on bestpractice topics, so not just about the bareminimum but how are you going as a business interms of flexible work practices for your staff,helping them manage their work life balance and howdo you deal with problems when they come up ifthere's disputes or grievances.

each topic only takesaround 10 to 15 minutes to complete and you cancomplete as few or as many as you like and you candip back in and dip out. results and resourcesare all saved in the one section and you can alsochoose to have the links emailed to you in aresources links email to you so you can go back tothem easily at a later date. you'll also get immediatefeedback as you move

through the quiz becausepart of challenge in this space is figuring out whatis your knowledge gap and if you do have one. and if it looks likeyou need some help with certain topics, we've gota heap of great tools and resources which areavailable to help you out. we're not just pointingout the deficiencies, we're saying we understandthat could be an issue so here's some things tohelp you get it right.

being proactive inrefreshing your knowledge and ensuring that yourbusiness is compliant is one of the best defencesagainst compliant action but it's also aboutwanting to be a great employer so good staffcome to work for you and they want to stayworking for you as well. a third step of staying upto to date is to be made simple, in line with whatyou said about subscribing to our employer newsletterat fairwork.gov.au and you

can also sign up for apersonalised my account portal where your websiteexperience with us is personalised to yourbusiness size and also your industry as well soyou're not having to look at a whole heap of contentthat's just not relevant. by subscribing toour newsletter, any changes or updatesthat come through that are relevant to your businesswill be delivered straight into your inbox and you canbe sure you won't miss a thing.

scott pape: now, steve,when small businesses need info, they need it quick. what's the ato doingto speed that up? and it's a verygood point. we're all saying aroundthe table that information is the key and in atime-poor environment, the newsletters that doprovide a valuable source of information for peoplewho require an up-to-date service on the things thatimpact on their running

the business. but i will say there isother services that the ato also provide to helppeople keep abreast of developments and also findinformation to help them with runningtheir business. now, we heard though ourconsultation that we need to do more work on ourato.gov.au website and we've redesigned thewebsite and it's now much easier to find what peopleare looking for in terms

of - particularly insmall business inquiries. we also have an ato app. now, this ato app allowsindividual taxpayers and small business owners andself-managed super fund trustees to access all thetax and super information they need while on the go. so the app is available onall the smart devices and it includes a log-inservice for the online services that we provideincluding the lodgement

over mytax, by the way,and allows tax payers to lodge and track theprogress of their returns. the app also facilitateswhat we call voice authentication. so you now don't need touse passwords to get into the online services ifyou've registered your voice on our voiceauthentication, sort of, system and that means justusing your voice can allow access into ouronline services.

but the app also has anumber of useful tools and calculators and theability to set key date reminders and alerts isvery, very important. so it's very critical thatpeople make access of all of these sort of servicesthat are available to them in terms of getting theinformation they need to ensure a successfulsmall business. and now we're going toturn it over to you, the audience.

if you have got anyquestions, please submit these byhitting the ask a question button. and while we're waitingfor questions to come through, we'd liketo hear from you. what would you find tobe the most helpful in meeting your legislativerequirements? we've got a poll here. would you choose moreonline interactive

sessions, suchas this webinar, more on-demand resourceslike online courses that we've heard about andweb content or more opportunities to interactface-to-face such as, you know,business-hosted events. you can respond now bysubmitting your responses to the poll in thewebcast screen. but while we're waitingfor that poll to come back, i've got my firstquestion and it is to

lynda. lynda, wehave - robert asks my business is not doing aswell as it used to and i can no longer afford tokeep all of my staff. am i able to let go of anemployee or will this be considered unfairdismissal? lynda mcalary-smith:great question, robert. and, firstly, it'sunfortunate to hear that your business is goingthrough tough time but

it's also really good tohear that you're having a think about what optionsmight be available to you and, sort of, doingthat in a planned way. there's a couple of thingsto think about and there's a lot of myths aroundabout unfair dismissal and one of the first things iwould say is if you've got a genuine and lawfulreason for terminating an employee and you do it ina fair and proper way, that will be okay.

and there's a few stepsthat you can do to make sure that youfollow that process. whatever happens in termsof the reason for the termination, you do wantto make sure you follow the correct procedure. before i go into thata bit, i will say, of course, particularlyin small businesses, you're working with peopleand people potentially you might have workedwith for a while,

and you understand theimpact that their business - about them leaving thebusiness and losing their job could have on them andtheir family and that can be tough, too, so don'tforget to look after yourself when you'redealing with these kind of issues and seekadvice if you need to. so if you're a smallbusiness who's got less than 15 employees, there'sactually a small business fair dismissal code whichactually takes you through

the steps that you couldfollow in terms of testing whether or not yourreasons for wanting to terminate someoneare lawful. you can't terminatesomeone for a course because, fordiscriminatory reasons, for example, if one ofyour staff members tells you that they're pregnant,for example, or they want to come backto work or, you know, they're caring for asick family member.

those ones are a no-noand, generally, they're, sort of, a common-senseapproach to what you shouldn't be doing. if you follow the smallbusiness dismissal code, that gives you some senseof protection and some good practice as well. now, in terms ofbusinesses who might have more than 15 employees butstill consider themselves a small business, it'sstill good advice to

actually follow theinformation that's set out in the small businessdismissal code. if you're pretty sure thatyou're making the right decision for your businessand you're doing it for the right reasons,it's important to keep documentation thatsupports the reason that you've made your decisionand also to think about what entitlements theemployee could be owed. if, for example, you'reterminating someone

because they're redundant,not only do they get things like theirannual leave paid out, they're entitled to noticetime and they're also entitled, potentially, toredundancy pay as well. in terms of notice, you dohave a few options up your sleeve in that space. obviously, if you'regiving someone notice that you want them tofinish up working, you may or may not wantthem to hang around in the

workplace, depending onhow they respond to that and what their otheroptions might be. so a number of industrialinstruments actually give you the option topay out that notice. so, for example, if youhave to give someone two weeks' notice, youcould say, well, instead of workingout that two weeks, i'll give you the pay inlieu and you can leave in the next day orso, for example.

so it's making sure youtick all those boxes in the first instance. but if it's asense check that you're doing it for theright reasons, you're doingit in a fair way and you're providingthe person who's leaving with their entitlements,that's a pretty good sense check that you won't fallfoul of unfair dismissal. scott pape: and can ijust say on a practical

level, as a smallbusiness owner, i have actually been onthe website and been in those situations andit's a real help for small businessowners that may not go and see a lawyer and that justwant to actually get some practical advice whenyou're in the trenches. i would encouragepeople to go there. the next question we haveis for michael and it says you mentioned that largemerchants will be subject

to the surcharge laws thisyear and small merchants next year. how do you know if youare large or small? dr michaelschaper: okay. well, there's pretty mucha simple definition. lynda just mentioned onethat was about the number of employeesand, likewise, essentially there'sa definition here. if your firm has aturnover - there's three

elements and you've got tosatisfy only two of them but, really, in essence,the critical ones are if your turnover is morethan $25 million, if you have more than50 employees or if your assets of the organisationare worth more than $12.5 million, any two ofthose in combination. i think the really simpleway to think about that, scott, is $25 millionturnover is a really straight-forward one andso is the head count in

terms of employees. i have a question here tosteve and it says is it correct that the ato willaccept scanned copies of receipts in accountingsoftware therefore not having to keepthe original? steve vesperman: itis correct that scanned copies of the documentsare acceptable but you do need to ensure whereyou are recording those scanned copies.

so where is itactually being kept in terms of therecord-keeping, sort of, practices. so you need to be awareof where those scanned records are being kept. when we receivethem, of course, they are acceptable butthe real key is making sure that they are storedin a place which still can be retrievedelectronically.

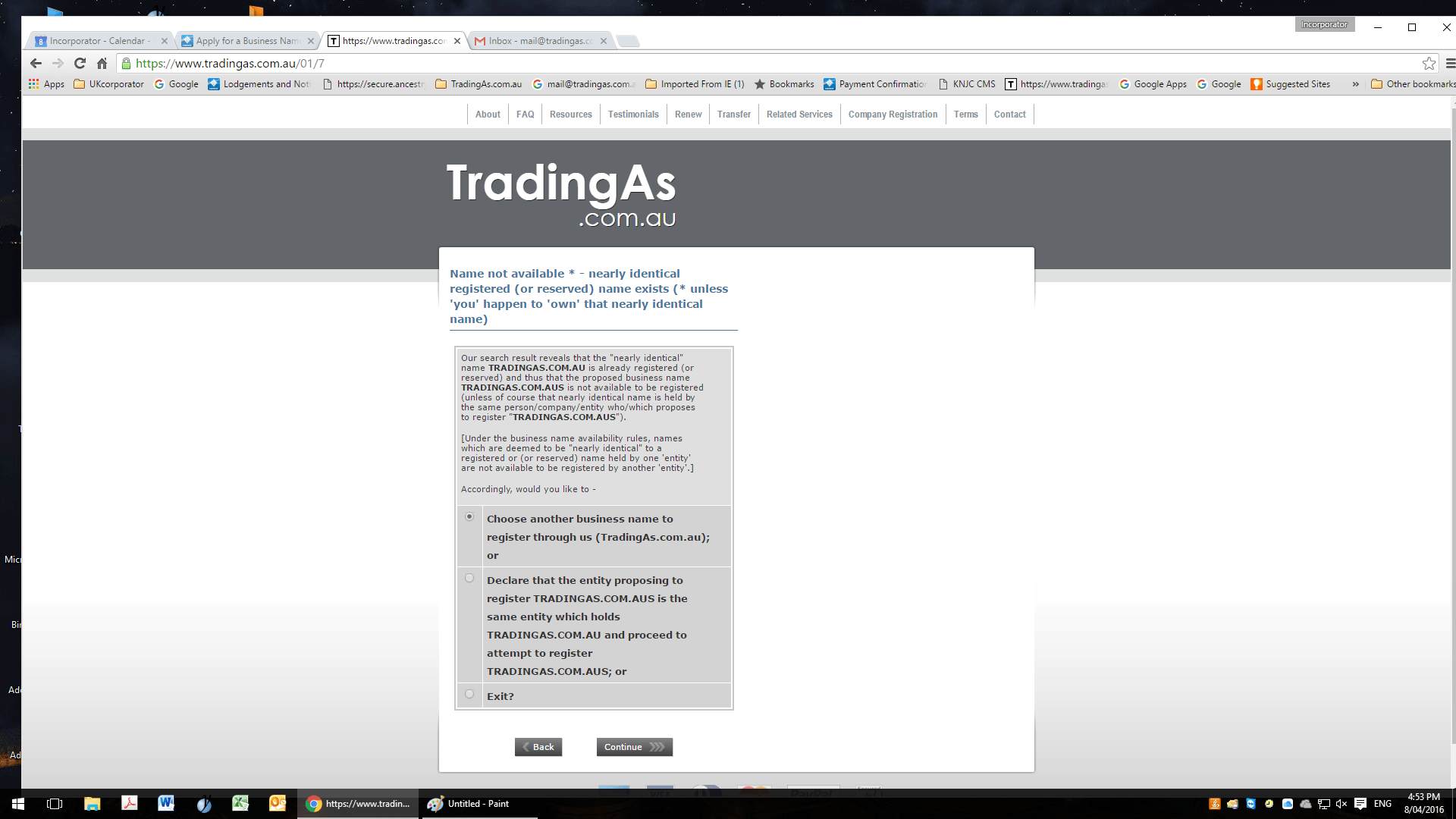

scott pape: okay, good. good point. joe, we have sophie. sophie asks how much doesit cost to register a business namecompared to a company? joe zubic: okay. so a business namecurrently costs about $34 for one year registrationbut you can - you do have the option of registeringfor three years and it's

currently $79. my understanding is from 1july it'll go to $39 for one year and $80for three years. now, with a company, acompany is around about $460 at the moment butyou've just got to remember that every yearyou need to pay renewal fees whether it be for abusiness name or for a company. and so withbusiness names,

it'll be the sameamount again if you're registering for one yearor for three years and for a company, it's abouthalf that price, it's aroundabout $220, $230. michael, devon asks, i'ma franchisee and i think some of the terms in myagreement are harsh and unfair. are franchise agreementscovered by the unfair contract terms law?

dr michael schaper: goodquestion and the short answer is yes. essentially, the unfaircontract law applies to all business-to-businessstandard form contracts. even though there is aspecific franchising code with a couple ofstipulations in there, it's still the case. interestingly enough, infranchising not only is the franchisecontract itself,

the franchise agreement,but of course if that contract also refers toother documents and that is common practice notonly in franchising but in many otherindustry models, they'll say here is thecontract but, by the way, you're also bound intothese other documents as well but in many casesthose other documents will be caught by theseprovisions as well. so if people are trying tothink here's a clever way

to get around theseprotections for small businesses, we'll justoutsource it to another piece of paper, that isn'tgoing to be the case. these laws and ourinterpretation are designed to ensure that wegive small business the biggest protectionof it that we can. aaron asks joe, i'mconsidering starting up a bakery and i'm not surewhether i should have a business nameor a company.

what are the differencesbetween the two? so i can't actually giveadvice about what's the proper structure to set upbut under the corporations act, a company is seen asa separate legal entity and what that actuallymeans is that is has its own rights. in fact, the corporationsact recognises it as a person so it has thesame rights as a natural person.

it can raise funds, it canbe sued and can actually sue itself, sue otherpeople i should actually say. and people generally setup a company for two reasons and one is toprotect their personal assets: that's one of thereasons why they do that, and the second reason isgenerally to minimise their tax if theyearn enough profits. there's some downsides toregistering a company and

that is the complianceobligations are significantly more andthere's a cost associated with that. now, with a business name,there's no separate legal entity between the actualowner and the business itself. so if the company fails,then the person who runs that company is personallyresponsible for its debts, unlike if you operateunder a company structure.

steve, we have - meg askswhere can i get help if i've maybe got a littlebehind with my tax? this is a question we doget quite often and the first decision to make isto do something as early as possible. so if you allow thesethings to go unchecked for a long period of time,it's harder and harder to recover. but there's a number ofplaces that you can go to

to get someadvice about that. on our website, we do havewhat's called a small business assist and youcan get information in that on that websiteusing that tool about what you need to do to recoverif you're a bit behind in in lodging eitheryour activity statements or your incometax returns. by the way, onthat website, we also have what'scalled alex,

the virtual assistantand that's a particular software that, asyou ask questions, it learns the sorts of thequestions that are being asked and providesresponses to you. so we're encouragingpeople to use that as much it really is a way, again, of providing a serviceto the community outside normal business hours. you can also request avisit from one of our

field operatives and theycan come out and help people work through ifthey are miles behind or just behind in their taxobligations and they will very clearly help you setthrough how do you ensure you get up to date andactually meet your obligations and hopefullyhelp you work through so you continue on to meetyour obligations on time in the future. now, another oneto you, michael.

this is actuallyquite a hot one. i'd like to knowthe answer to this. why aren't taxis coveredby the credit card surcharge law? steve vesperman: that'sa really good one, isn't it? and the really simpleanswer is because most state governments havespecifically introduced rules, legislation, aboutwhat the rate should be.

in many states it'sessentially a 5% add-on. so where statesspecifically legislate for something like this, thenconstitutionally they've got the full right to doso and so commonwealth laws like this take a backseat to it so that's a short answer to it. scott pape: very good. lynda, peter asks, i'm inthe security industry and i'm confused by some ofthe entitlements i have to

provide to my employees. where can i get helpspecific to peter's industry? lynda mcalary-smith:well, peter, you can come directly tofairwork.gov.au or to our small business helpline at 13 13 94. through our website, youcan actually go through and select that you are inthe security industry and then it filters out allthe other content so

you'll only actuallysee the content that's relevant to thesecurity industry. there are a number ofrequirements that are set out in the security award,if that's what you're covered by, and it goesthrough all of those sorts of things in aplain english way. so we've done thetranslation of some of the awards, actually, foryou and, as i said, it's industry specific soyou're not seeing general

information just - orgeneric information, you can comfortably applyit to your particular scenario. we've also got a functioni mentioned earlier around our dedicatedportal, my account, where you can actually gothrough and set up your business size, where yourbusiness is operating, what your typeof industry is, even getting down to thelevel of sub-industry and

then you can save all yourinformation in that spot. you can have a dedicatedonline inquiry channel through to some of ourtechnical experts. you can also save payrates, for example, in there and you cansubscribe to updates. so, again, some of theseworkplace relations, good processesyou can set up, can then operate in thebackground and it doesn't need to be at theforefront of your mind.

so that's atfairwork.gov.au and if you want to have a chat tosomeone in person or on the phone, 13 13 94 andselect the small business help line number andyou'll go straight through to our priority queue. scott pape: excellent. steve, one for you. tim asks, i'm a soletrader running a start-up that is only justbeginning to make some

money. well done, tim. i also registeredfor and charge gst. what's the minimumpaperwork that i need to complete at the endof the financial year. steve vesperman: okay. so when you areregistered for gst, and you do have anobligation to lodge a business activitystatement probably every

quarter as a new business,so those quarterly activity statementsare required. then at the end ofthe financial year, you do need to prepare anincome tax return which is bringing to account all ofyour sales and, of course, all of your expenses arerecorded there as well as part of lodging an incometax return itself. now, there is areconciliation that's to be undertaken in terms ofthe activity statement and

the income tax return andthat can be done either yourself or you canactually go to a registered tax agent whocould help you do some of that work as well. but the most criticalpart of the end of the financial year viewis looking to see the viability of the business,so are you actually operating at a profit andalso are you managing your cash flows.

so if that's alsoconsidered as part of your end-of-year obligation,it just sets you up for a successful yeargoing forward. scott pape:excellent, steve. well, i've got hereone last question. satija asks, i'm ateenager and i'm starting a business thatprovides piano lessons. i currently do not havea website but i'm going around door-knockingaround my neighbourhood

for some business. i'm wondering if it'srequired for me to register for things likean abn and a tfn as well - a tax file number -as well as many other requirements fora sole trader? steve vesperman: soundsa wonderful entrepreneur. and my advice there isthat there is a difference between whether it's justa hobby or whether it's a particular business.

and there's informationavailable on our website but there's also atool available on the department of industrywebsite that's now starting to help peopleget some certainty on whether it's actuallya hobby or a business. so each particular caseneeds to be determined on its facts and by gettingsome advice from our website, but alsousing that tool that's available, can help usdetermine is it a hobby or

a business itself. so returning tothat poll question, what do you wantmore of, well, the majority of you saidyou want more - we're in luck, guys - online,interactive sessions such as this webinar so wemust be doing well, 57% of people said that. 30% said more on-demandresources like online courses and web contentlike you're delivering,

lynda, and 11% said moreopportunities to interact face-to-face such ashosted business events. i'll let our regulatorstake that on board and see what they cancome up with. so, ladies and gentlemen,we have reached the end of our session. first of all, i'd liketo thank all of our presenters, lynda,michael, steve and joe, for giving up your timethis evening and providing

us with some really usefulinformation through your presentations and answersto the audience questions. i'd also like to thankeverybody that's tuned in tonight. we hope that you've foundthis to be an informative session for you and yourbusiness and our goal is to make doingbusiness easier. i'd like to mention that avideo is going to be made of this presentation thatwill be made available as

part of the regulators'information package that will be comingout in due course. so thank you everybody fortuning in and goodnight.